Mortgage rates held steady after a mixed jobs report, with unemployment rising and job growth coming in stronger than expected. Learn what this means for homebuyers and what to watch next.

Published on 11/21/2025

As the homebuyers grow into the home more comfortably, they can always refinance into a 30-year fixed rate.

Published on 11/17/2025

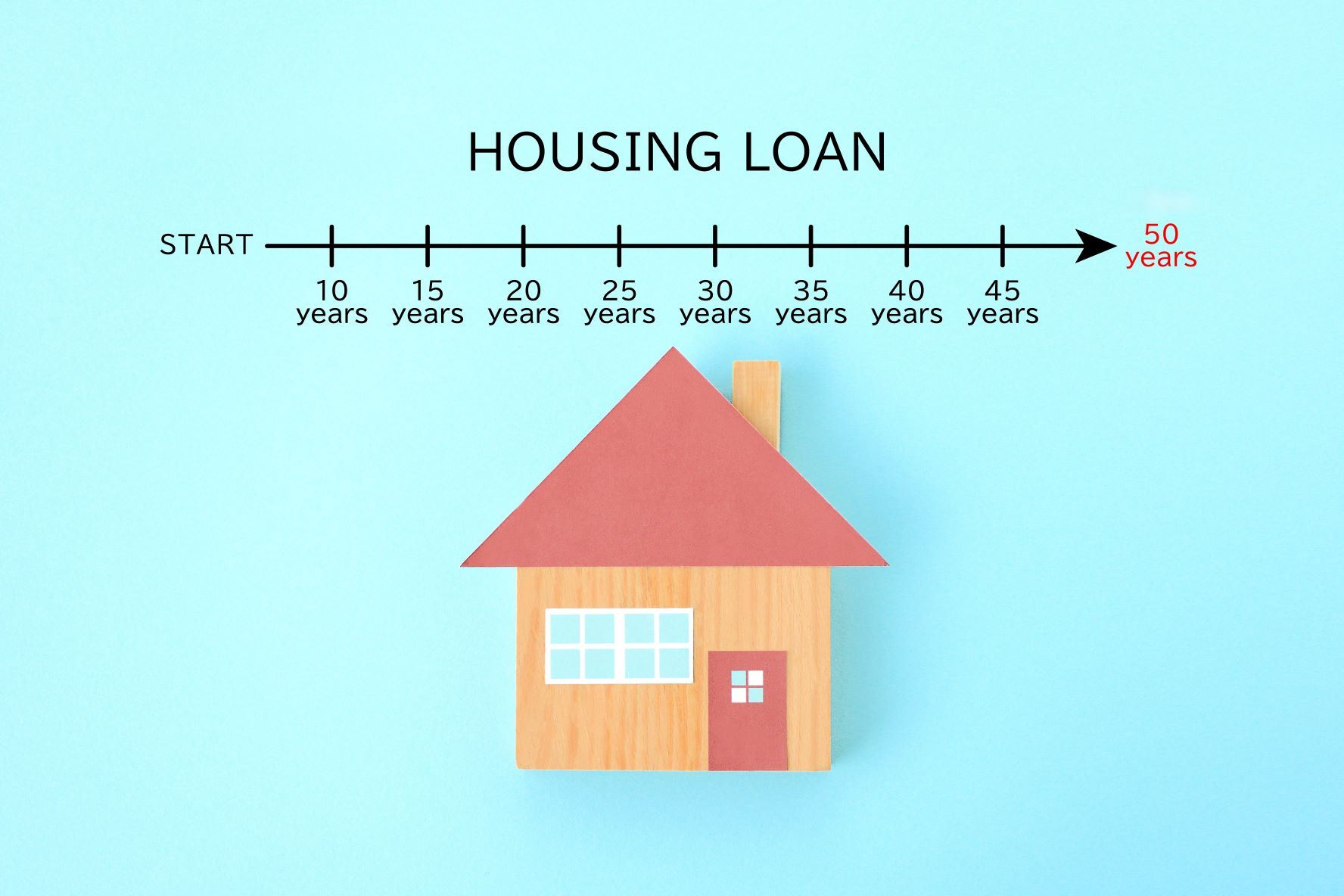

The Trump administration says it’s exploring 50-year mortgage options to help with affordability. Learn what this could mean for homebuyers, monthly payments, and long-term costs.

Published on 11/11/2025

This is good news for those who might be on the credit bubble with a low FICO score but have strong income and cash reserves

Published on 11/10/2025

Fannie Mae’s new credit score policy lets lenders use automated approvals even for borrowers below 620. Here’s what that means for homebuyers who thought they couldn’t qualify.

Published on 11/08/2025

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

Published on 11/06/2025

Most think mortgage rates will go down, while others see danger signs in labor market and homebuying affordability

Published on 11/03/2025

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

Published on 10/29/2025

The 30-year fixed rate averaged 6.19%, 8 basis points lower than last week

Published on 10/27/2025